Who Else Wants Info About How To Write Off Business Expenses

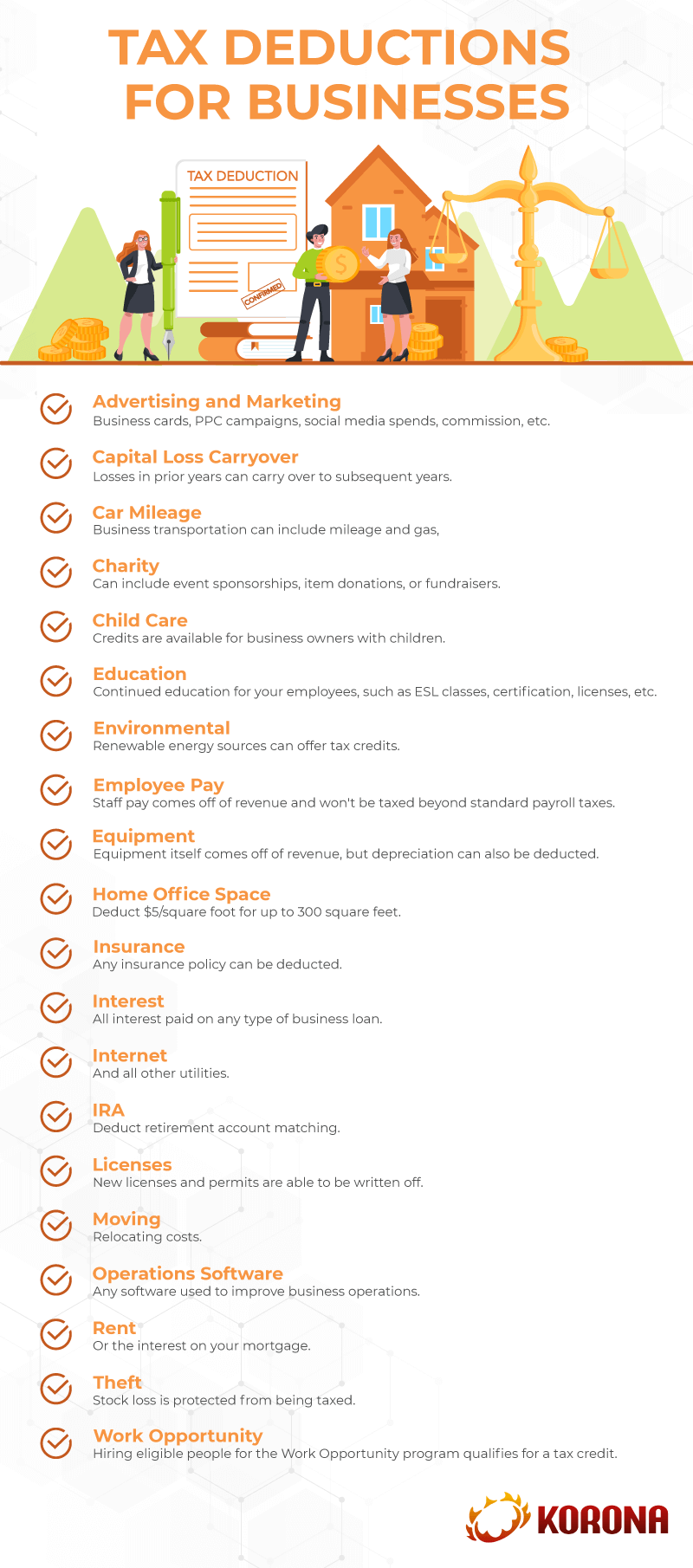

To claim unreimbursed business expenses, list the sum on schedule a (your itemized deductions worksheet) under “job expenses and certain miscellaneous deductions”.

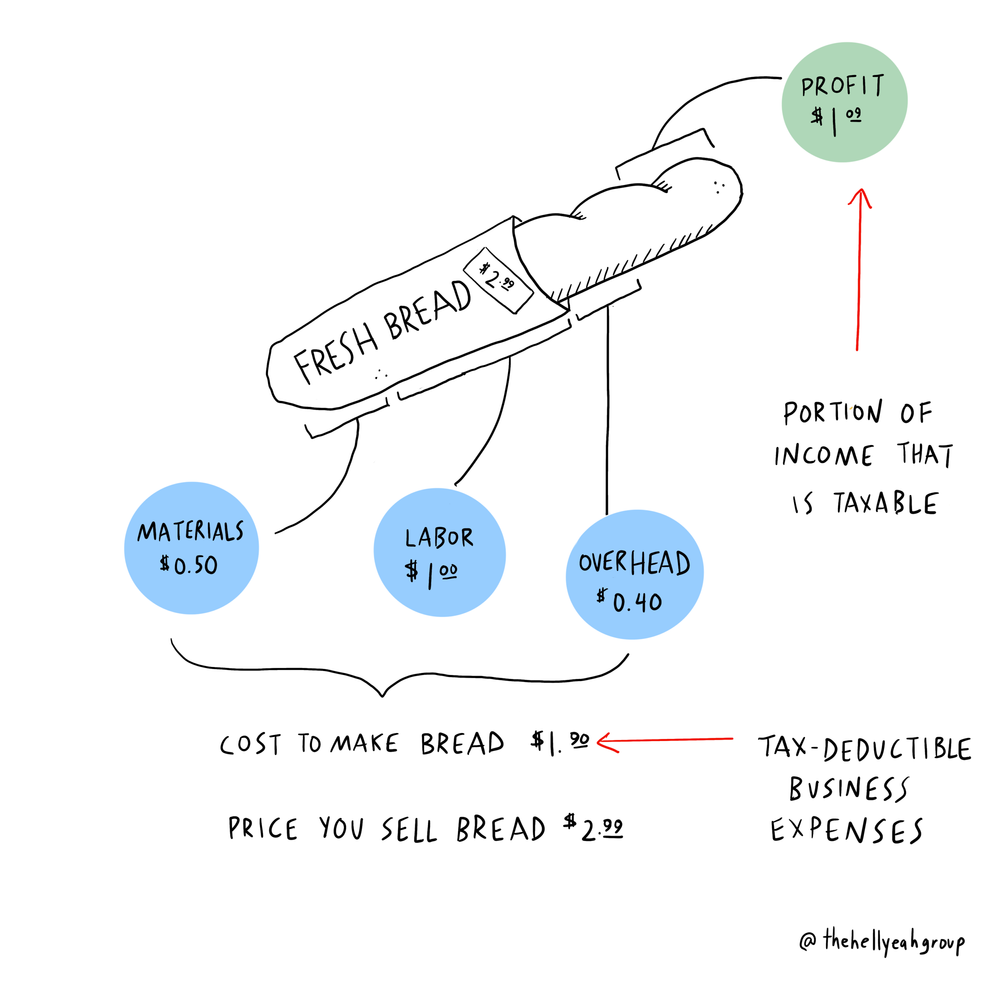

How to write off business expenses. These expenses must be common for your type of business and also necessary for your operations. If you spend less than 25% of your time working, you can still take deductions, but only as a percentage of the total cost. You may deduct no more than $25 of.

Tips for writing off business expenses. If it’s not your business you can’t write off the expenses. This includes the cost of airfare, gas mileage, or other transportation.

3 so if your. Business expenses are deducted on schedule c. To obtain the deduction amount, multiply the sum of actual vehicle expenses by the business use percentage.

This limit applies if your costs are $50,000 or less. There are various deductions and ways to include vehicle operating costs as business expenses. Business expenses incurred during the startup phase are capped at a $5,000 deduction in the first year.

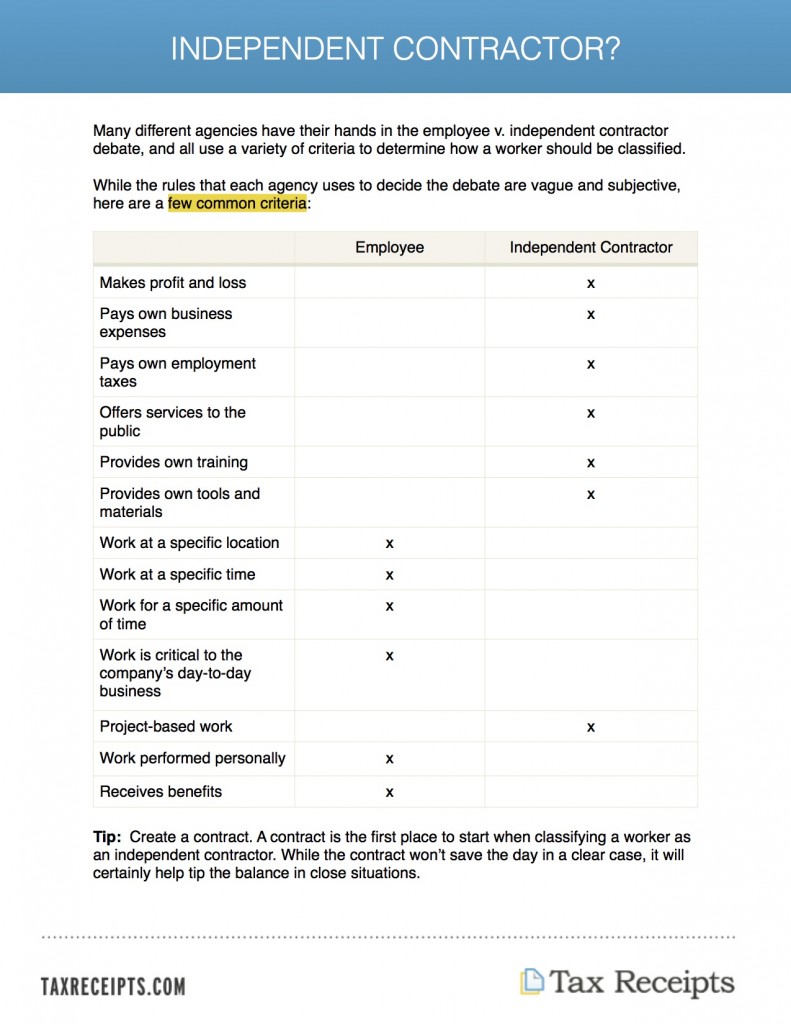

An llc may elect to be taxed as a corporation (a.k.a. Alternatively, you can use the actual expense method to deduct the business. Spend 25% of your days doing business.

Business i currently own:• an income tax pre. Write off any business expense. You can write off your mileage for the year, including your car expenses for business, charity and medical trips.

![Small Business Tax Deductions For 2022 [Llc & S Corp Write Offs]](https://www.ais-cpa.com/wp-content/uploads/2020/03/less_known_tax_deductions.png)

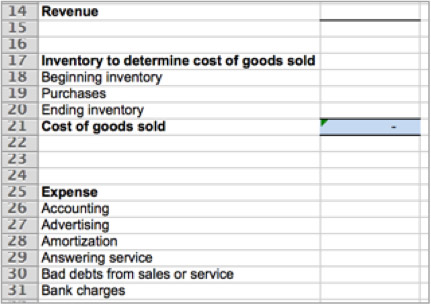

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

.png)