Can’t-Miss Takeaways Of Info About How To Reduce Expected Family Contribution

Legal ways to reduce your expected family contribution maximize household size.

How to reduce expected family contribution. Repeal of the lifetime limit for times a borrower can receive subsidized loans of up to 150% of program length removal of the number of family members in college from the. Here are a number of perfectly legitimate ways to reduce your expected. That means that a family with $150,000 of income and no assets would be expected to contribute over $40,000 per year towards college ($150,000 x 27% = $40,000), mckenna said.

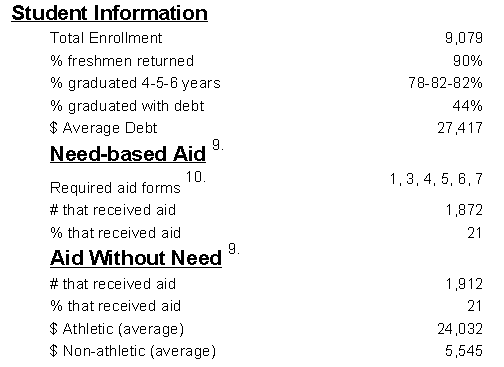

If the contribution from assets is negative, it is set to zero. Increase college attendance among family members if you are considered a dependent student on the fafsa, the college enrollment status of your family members are important. The sum of the following allowances reduces the parents’ total income:

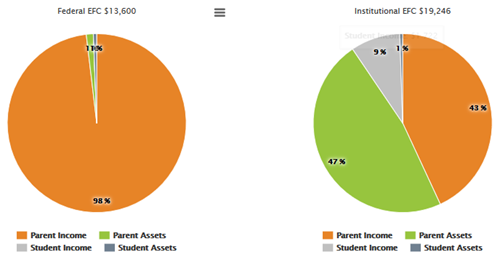

How is your efc calculated? How to reduce your efc and increase your financial aid elgibility. The larger your household size is, the lower your efc will be (in most cases).

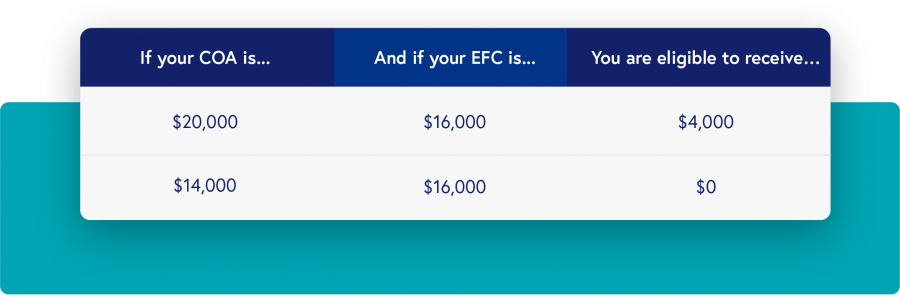

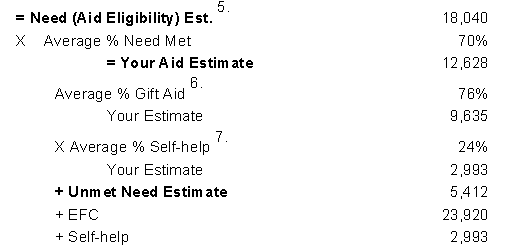

Unfortunately, it’s difficult to reduce an efc except at the margins. Step 1 calculate your efc. Some schools simply remove any external scholarships that you.

Begin your estimate for federal student aid. The efc calculation is computed by using the family’s financial data submitted on. Plug new numbers into the efc calculator if a family’s financial situation changes due to such things as a divorce, separation, death, disability, job loss or the care of an elderly parent.

Step 3 evaluate aid eligibility by school. This is the final step in determining the parents’ contribution. Some schools ignore the value of the families residential home in calculating assets, others include it.

![How To Lower The Efc [Legally] – College Reality Check](https://collegerealitycheck.com/wp-content/uploads/college-money-1025.jpg)