Brilliant Strategies Of Info About How To Lose Money On Bonds

Open an online treasurydirect account.

How to lose money on bonds. You receive the original purchase price plus interest earnings. Many people believe bonds are a safer alternative to stocks, especially. Interest rates on i bonds are adjusted regularly to keep pace.

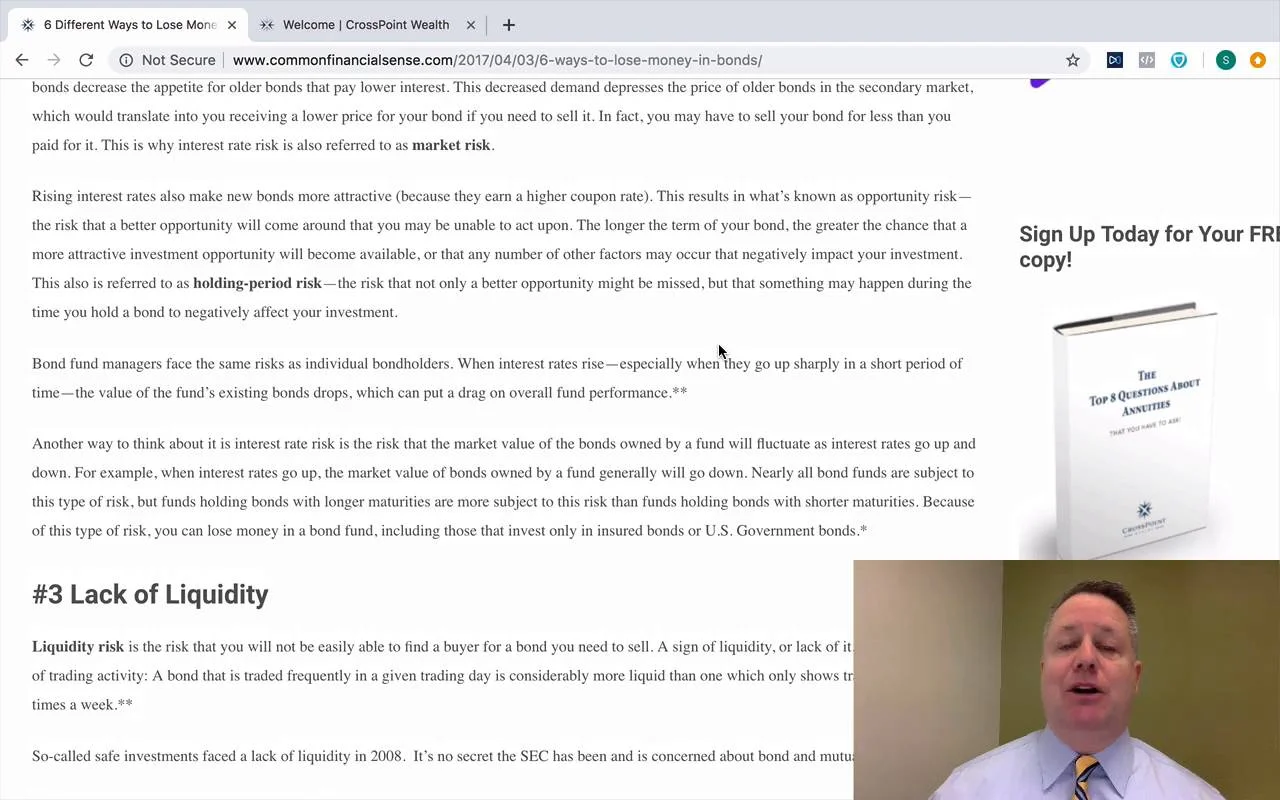

Rising interest rates one of. If rates spike and investors start pulling their money out of the fund, the. Can you lose money on bond funds?

There are two ways investors can lose money when inflation starts rising. Did you know that there are 7 different ways to lose money investing in bonds? Ad position client portfolios for inflation.

The bond's face value, approximate issue date, the name and social security of the bond holder, and the serial. Equity funds secured $3.99 billion in net buying after facing outflows for four successive weeks. The bonds were accumulated under a a$300 billion emergency stimulus program that ran from november 2020 to february 2022.

Bond mutual funds may lose value if the bond manager sells a significant amount of bonds in an environment of rising interest rates and open market. Let’s say your income tax rate is 20%, and you buy an i bond for. If you own any bond and the credit rating agencies downgrade the credit worthiness of the underlying company or country than your bond will fall in value.

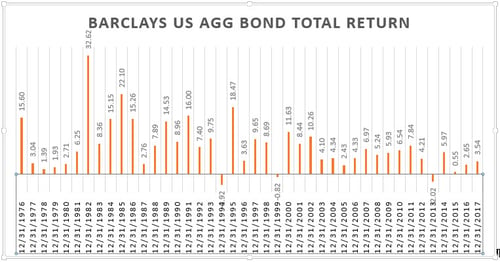

You can cash i bonds once you have owned them for a minimum of one year. First, the fed will usually react to inflation concerns by raising interest. That’s because when rates rise, the prices of bonds fall.

/GettyImages-1277683722-dbacb99c045d4c7bb041d01db8ef7bc5.jpg)

/GettyImages-1277683722-dbacb99c045d4c7bb041d01db8ef7bc5.jpg)