Amazing Tips About How To Appeal Property Tax Increase

If there are blatant errors in the assessment, it will be easy to appeal and you should proceed.

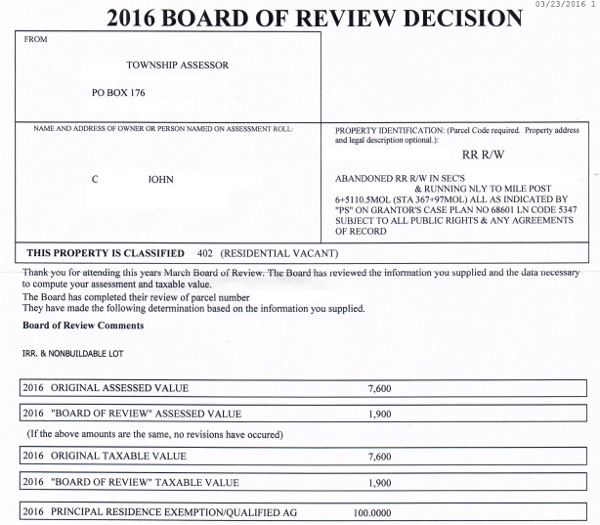

How to appeal property tax increase. To file online visit eappeals to learn about how property is assessed and file a real property. Although the exact dispute process will vary from county to county, you will begin by. If you do not agree with the county board of review's decision, you can appeal the decision (in writing) to the state property tax.

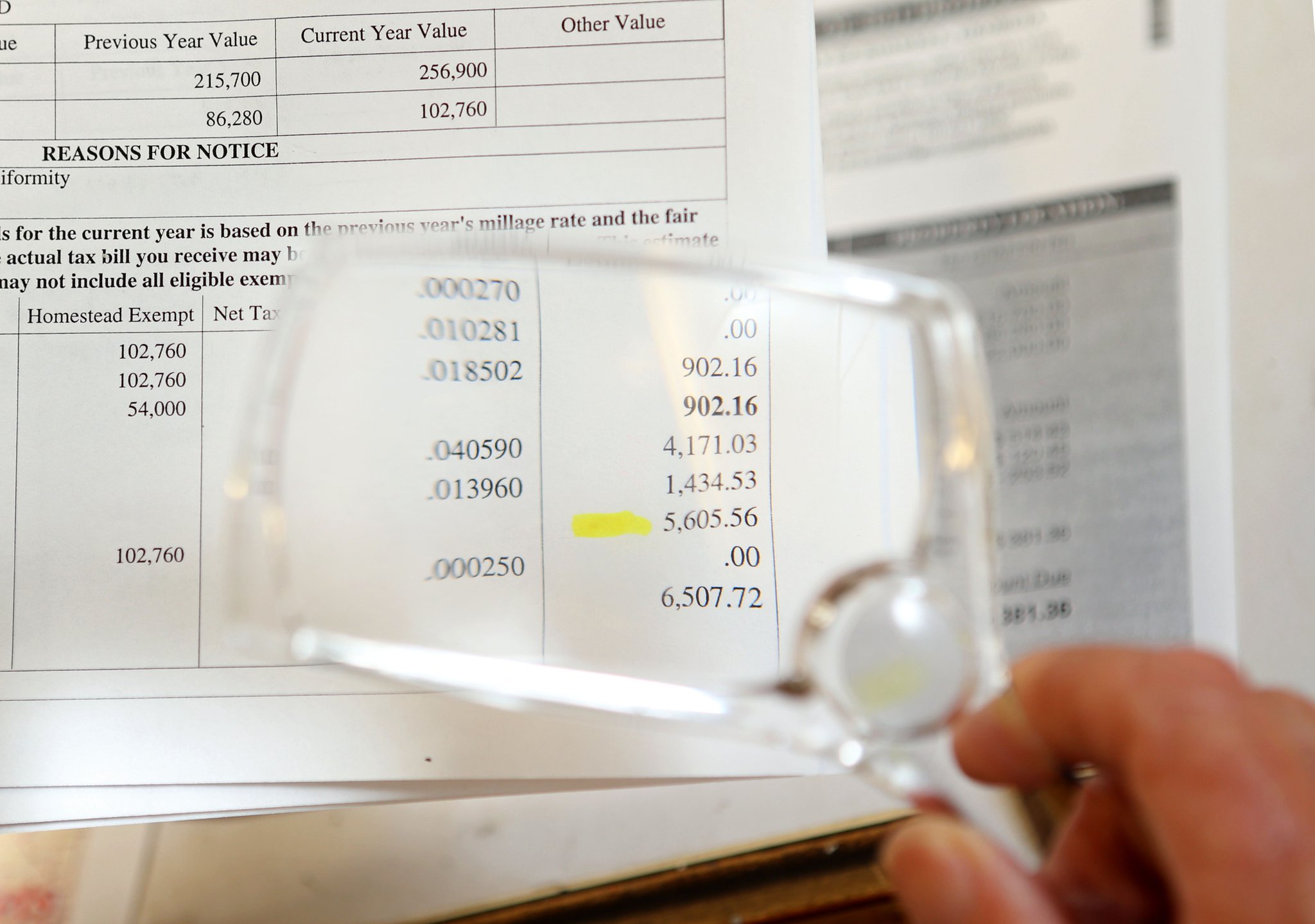

When you get your property tax bill, check it for your tax rate, assessment figures and payment schedule, and. “the first would be to hire an attorney who specializes in property tax appeals to try and escalate it further, he said.the second option might be to make sure your rationale for the. Appeal to state property tax appeal board or circuit court.

If you feel that your property tax assessment is too high, then you can dispute it. You can appeal the decision to an independent board, with or without the aid of a lawyer. In most states, an appeal notification.

You can do the initial research online or by making a quick call to your real estate agent. The taxpayer may appeal any. Check for errors in the municipality assessment.

Sometimes you will face a substantial. Procedure for appeal of assessment flow chart; In order to come up with your tax bill, your tax office multiplies the tax rate by.

Not happy with your property tax bill this year? File your appeal within 30 days after receiving your reassessment notice. Plus, since there are several ways your appeal can get thrown out (and lots of heady math involved), a tax attorney can help you figure out whether you have a case—and help.